**DISCLAIMER: I own a lot of supply from what's mentioned in this episode, and TFM is partnered with NFTU and Candy. However, that does not prevent us from exclaiming our opinions, as we have editorial control here. Take that as you will!”

Whaaat’s up everybody.

This is the first time ever that I’m writing a post alongside the podcast. Exciting! Going forward, each pod will come with an email, which may or may not contain additional information such as charts and data, as well as a variety of personal lists of what I’m into this coming week.

It all comes in an effort to grow our community and make more shareable content. I want to expand the podcast beyond just my voice and into an easy-to-digest written format, which won’t match the podcast word-for-word, but rather expand on some of the content.

These will come out every Monday morning.

As usual, thanks for being here! -LG

Today’s Pod - Burning Will Transform NFT Sports

How Burning Was Born

From the very early days of NBA Top Shot, we knew that burning was going to be a thing.

It was way back on October 5th, 2020, the day after Game 3 of the NBA Bubble Finals. TS did a drop for Eastern Conference Finals and Western Conference Finals packs, and for the first time ever—they didn’t instantly sell out!

This was likely due to the fact that the team at Dapper had expanded the supply of what were supposed to be “Rare” moments, from /275 per moment for the Conference SemiFinals set to /999 per moment for the Conf Finals (yes, that’s how long ago they started overprinting).

As the weeks went on, and the season wrapped up, Dapper eventually pulled the packs from the “shelf” and let it be known that the remaining supply would be burned.

Then—a long silence.

Top Shot Winter came and went, and it wasn’t until June 8, 2021 (eight full months later), that burning was yet again referenced officially in a blog post about each moment’s supply ticker.

The blog proclaimed that the remaining ECF/WCF supply would soon be burned (which didn’t happen until November 30th, 2021 - another six months later). And in reference to other moments being burned: “for now, that will always show zero as no burn feature has yet been implemented in NBA Top Shot.”

And so, we waited.

And we watched as Series 2 ended, Series Summer ‘21 (??) came and went, and Series 3 kicked off with a MASSIVE roadmap that promised an astounding 18 sets released in just nine months.

Personally, it was around the Fall of 2021 that I began to publicly (and privately) advocate for reducing supply. I made it known that a solve to Top Shot’s cratering market cap was a major reduction in total supply.

Through the end of the year and the start of 2022. Through every new Dapper product launch (NFL All Day, UFC Strike) and non-Dapper sports collection launch (Candy Digital’s MLB ICONS, Recur Forever’s NFTU), we saw the same cycle occur.

The cycle was so simple:

New supply

No utility/challenges

No reduction

Appetite dries up

With no drain, these faucets of sports NFTs were overloading the nascent market.

And I took every opportunity I could to point this out, going as far as to write a podcast pointing the finger beyond these projects and more so at the sports leagues themselves. I used the pod to point out how terms like “community value” and “secondary market” were way beyond the imagination of a 100-year sports league business machine.

The episode was #156, titled “Will Sports NFTs Survive” (listen on Apple or Spotify).

And then finally—FINALLY—after months of promises and speculation, we were told by the NFL All Day team that burning would commence on Friday June 3rd, 2022.

It promised a few things, including a 24-hour burn option for common-only pack pulls and a future 100,000 moment reduction in supply.

Here was the result following Friday’s drop/burn event (per NFL All Day):

466 out of 1000 packs burned

That’s right. Almost HALF the people who opened 3x commons decided to burn them in exchange for a $14 loss.

That’s half the people who decided that $14 was an acceptable cost for rolling the dice on potentially pulling a valuable All Day moment.

Not bad for a first time around.

Burning is imminent on many sports projects

Let’s take a look at the list of Sports-Card style projects and their burning status:

NFL All Day

466 packs (of 1,398) burned from WildCard Weekend supply

100,000 more being burned this summer from the Week 13-18 supply (which equates to 5.4% of supply, per Jon Jackson)

Promise of burning challenges coming this summer, utilizing existing supply

NBA Top Shot

Literally starting any day now, as promised two weeks ago

In fact, its so imminent that the video EXPLAINING the crafting was leaked this morning (though it contained erroneous info)

No other details yet on what will be burned

Candy Digital MLB ICON

Announced in April that “crafting” was coming to the platform

Revealed that crafting will be on a per-point system, and that the cards you burn will need to feature a majority of the player you are crafting

Example from the Candy Blog:

*note: i freaking love this system, and hope it works well!

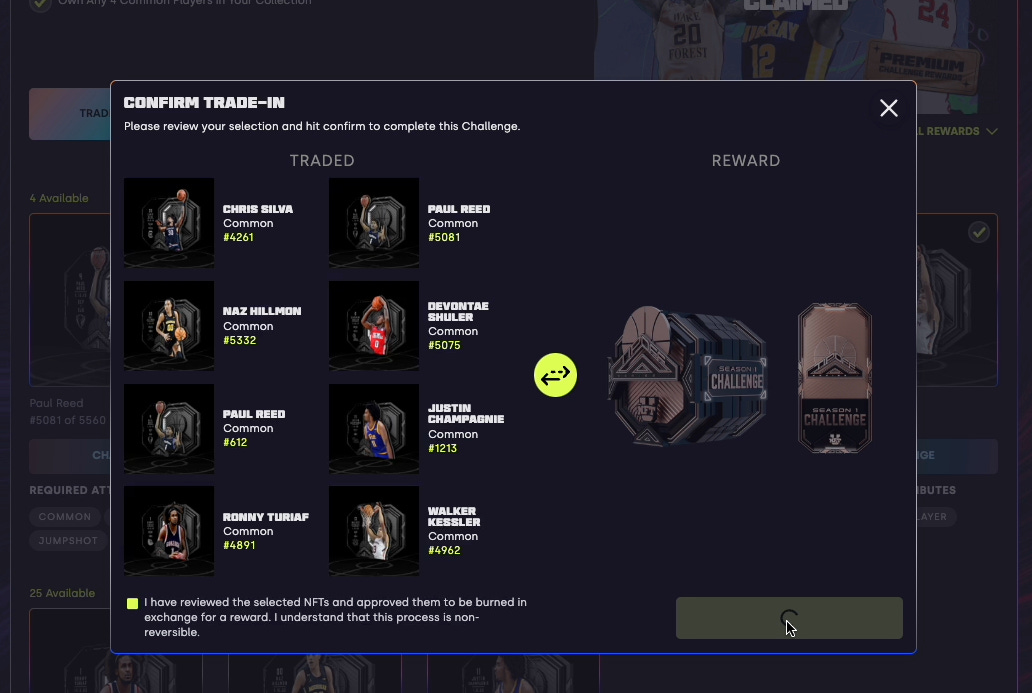

ACTUAL BURNING: NFTU from Recur

So this one has gone a bit under the radar.

NFTU, the flagship project from Recur Forever, features former (and current) College Basketball Stars like Ja Morant, Carmelo Anthony, and Kevin Love.

Last month, they actually rolled out a pretty efficient, ticket-based burning system to reduce supply.

It works as so:

Complete a Common challenge

Receive a “Premium” Card (next tier up), and a “Premium” Challenge Ticket (which is also an NFT)

Complete a Premium Challenge, where you NEED several of the Premium Ticket, to then earn a Rare Card + Rare Ticket.

I really dig this system as it hits two key elements of what I would consider a strong crafting system:

Reduces supply (which in this case, bumped floor price from $1 to $3)

Introduces another token (Challenge tickets)

The Challenges can also be completed multiple times by one user but have a set limit of completions. For example, the challenge below can only be completed 1600 times, which is vital in providing clarity on ecosystem dynamics.

*Note: The First Mint is currently partnered with NFTU to help promote the product. However, including them in this issue was not a contractual obligation.

Burning in the rest of the NFT world

Outside our beloved institutional projects, there are tons of fantastic burning mechanics present in other blue chip NFTs.

We can learn a lot from how other leading projects manage their supply; in fact, it would be wise for the sports project to follow their leads, as many collectors and users likely overlap and would understand these mechanics off the bat.

Notable projects with burning mechanisms:

Damien Hirst The Currency: 10,000 unique pieces wherein owners have the choice to burn their NFT for a physical version. A year from release, all remaining digital and physical supply is burned, capping the total pieces at 10k.

Pixel Vault: Shortly after the genesis NFT (Punks Comic Issue #1) sold out, owners had to make the choice between burning it for the Founder’s DAO token (an exclusive club/DAO), or keeping their issue. And the choices haven’t stopped since!

Huxley: One of my faves, and similar to PV in terms of a comic theme. Collectors must burn varying supply of issues #1-3 of the comics, in order to earn a Genesis Token, which is then burned for a PFP. This reduces overall comic supply, but also balances the PFP supply.

Now you’ll notice that each of these examples requires a difficult choice, a vital part of a great NFT project.

You’ll also notice that these projects have either made their burning dynamics crystal clear from the very first day (Hirst, Huxley), or completely omitted any future details to let the genesis NFT act as a sort of Matryoshka doll (Russian doll), where the original piece constantly opens into new possibilities (Pixel Vault).

These projects know that for their collectors, NFTs are a journey, not just a destination, and that choice-based gamification maintains interest.

Before we dive into the actual crafting and impacts on sports project, I think we need to zoom out and look at the top level goal of these projects. What are they trying to do exactly?

Sports League NFTs: What’s the goal with burning?

On the surface, many of these projects (NBA, NFL, MLB, etc.) like to market themselves with the classic web3 tagline of “the future of fandom.”

Its a line that insinuates that this is a sophisticated spaceship-like product that will transform your mundane TV-watching sports experience into a whole new experience.

And honestly, I don’t fully disagree with the tagline’s merit—regardless of where this all goes, sports league NFTs have already birthed a new paradigm of collecting and connection. Personally, I’ve used these collections to return to leagues I had long left behind (like the NFL) and those I had never previously bothered with in the first place (like the UFC).

But from a business standpoint, future of fandom is not a bottom line.

These are consumer tech products at the end of the day, and with so much VC money behind them, their success metrics are pretty straightforward:

Active Users

User Retention

Customer Lifetime Value

Users engaging. Users spending. That’s it.

For any NFT project to achieve this, it needs to develop and stimulate an incredibly active economy. One that sees people engage regularly and spend often. A strong mix of super users, passive users, and returning users, coupled with excellent reason to buy/sell/trade on the regular.

In their current, non-burning states, the Sports League NFT projects have seen their daily active volume slowly disintegrate, and only peak during one period (supply drops). It’s been incredibly difficult to drive new users and overall demand.

In the case of a product like NBA Top Shot, which went from 200,000 people in pack queues at the peak to somewhere between 10,000-30,000 users now, they need to stimulate that economy by targeting two key groups spenders, each with a completely different level of NFT knowledge:

NFT Degen Traders, some of which might be returning users, and all of which are active on a weekly basis.

The general public and fans of the league, most of which still have never heard of the product, but have maybe seen NFTs on the news.

Not an easy demographic to hit.

And that’s why each of these products has now turned to gamification (a.k.a., a series of difficult choices) to get their metrics back on track.

Despite the dreamy message of future of fandom, these projects have all had to ditch the “collectible-only” aspect and resort to what their communities (and I) have been clamouring for: burning.

How They Can Be Burned

With goals, demographics, and challenges out of the way, we can finally turn to the far more exciting part: what we are going to burn NFTs for.

Inevitably, a burning mechanic introduces some type of secondary token into the economy. Doesn't matter what it is, even if the token is NOT an NFT or on the chain - it’s heavy duty for a project to introduce some type of ulterior element.

The burning buckets below range in tiers of complexity, and implementing them will inevitably will come down to the courage of the project leads and the appetite of the community for gamification. And in some cases, the willingness of the league partner/licensor to go along with it.

Fandom Rewards

Complexity Scale: 2/10

Sending people to games. Doing Discord AMAs with famous players. Giving new forms of interesting access. Merch.

This is the low hanging fruit of sports league NFTs. It’s so low hanging in fact, that it should be expected. I would go so far as to label these Benefits of collecting, not Rewards, as the latter implies that you needed to keep earning points to get there, whereas Benefits come with the initial purchase.

Potential Functions:

Trade NFTs for exclusive merch

Trade NFTs for game tickets

Trade NFTs for content access (Pay Per View, League Pass, etc.)

I’d love to see something offered that is truly exclusive. Regular people can just pay for tickets, so these rewards need to reflect a type of exclusive fan club. Something unique.

Basic Crafting

Complexity Scale: 5/10

If you’ve read or listened this far, then this is self explanatory; you burn NFTs in exchange for a different one (and ideally fewer than how many you started with).

The NFTU system referenced above is already there, as was the WAX/Topps MLB system from early 2021. This is the simplest and most straightforward way to burn NFTs, and one that many if not all collectors would welcome into the ecosystem.

Its a great way to amplify challenges by making them high stakes, and to emphasize my favorite part of all this: difficult choices for collectors.

Potential Functions:

Trade 5-10x NFTs for 1x Rare One (and various levels of this)

Trade NFTs for credits + other NFTs

Trade NFTs for AllowList to new drops

Trade NFTs for AllowList to other projects

In the case of the last two, these AllowList spots could also be specific NFTs “tickets”, making them valuable on their own (should the burner not want that drop, or see more value in selling prior to it). Kind of like selling your spot in the Apple line.

New Token

Complexity Scale: 9/10

A new token—whether its in-game credits, trade tickets (like on Top Shot), or a challenge ticket (like on NFTU)—would mark the ultimate complexity here. But it would also fully commit these projects to gamification.

In the case of Top Shot, the trade ticket system essentially functions as a burn mechanism (although those moments do get recycled into trade ticket packs, which kind of feels like using your house’s grey water to water your plants), with the tickets acting as a key to high-value, unreleased series 1 NFTs.

However, that still feels like a half commitment to the system. Trade Tickets were introduced over a year ago, and yet they are not NFTs, cannot be withdrawn or exchanged, and have no clear future. Yet they mark the most exciting part of a fully gamified card collecting system: a second currency.

Potential Functions:

Token-specific supply release

Token-specific fandom rewards

Token-specific bid/offer system

Token-specific staking (topic for another day).

The end game for a second token, as you can see with the options outlines above, is to give these projects far more autonomy in their economies.

Ecosystem Balance

Complexity Scale: 11/10

Not for the average collector, and in fact something the project leads themselves would have to work diligently to craft.

But the absolute best and most complex use of burning would be to bring artificial balance to the ecosystem by dramatically reducing supply (Thanos-style).

I know the meme makes it seem simple, but the long term ramifications would be very challenging for the average user to understand, as it implies that the devs can and will reduce supply at will.

To balance the power struggle, supply reduction could be decided by community vote where collectors give input on WHAT is burned and HOW MUCH.

Burning as Marketing

Complexity Scale: 0/10

All of these functions also serve a secondary purpose for the sports projects: marketing!

Nothing would ramp up excitement more than a big ass billboard right on each project’s website that proclaims “NFTs BURNED TODAY: XYZ”.

This would signal to veteran collectors that supply/demand is being prioritized, and let new users know that they need to keep an eye on the economics (which—again—would signal a full commitment to gamification).

And why stop there. Burning should be an EVENT.

Last Friday, Dave Feldman, VP of Marketing at Dapper Labs, joined us on Twitter Spaces to discuss NFL All Day’s inaugural burning drop.

During that session, we joked with him about a literal game show, where people burn 1000+ NFTs to earn the chance to compete in a “Deal or No Deal” style show where they can either earn tons of money, cool NFTs, or just a lump of coal.

You can’t tell me you wouldn’t watch that!

The Impact of Burning

There are many effects that burning would have over time on each project and community. It’s impossible to predict them all.

However, here are some of the potential ones:

Short Term (3-12 months)

Leave a hole in the supply. As these projects move to burning, some may get very aggressive (again, Thanos-style), which would literally decimate the current supply and likely drive up floor prices. I’m talking like as low as 25% and as high as 50% reduction in active supply. This would be great and very dramatic.

Bring people back. Thousands of people started their NFT journey with Top Shot, and many of them are sports fans. Yet, they are aware that most of these projects are designed similarly to NBATS, where the supply is outpacing the demand. With a proclamation of ecosystem balance, these degens could come streaming back in.

Growing pains. Whatever the new system is thats implemented; it won’t be perfect for a while. There will be errors. Collectors will use the system in unexpected ways. It will be chaotic.

Long Term (1-3 years)

Reshape how projects release supply. Imagine a world, where a project like Candy Digital spends the entire baseball season releasing supply, and the entire off season burning 50% of it in challenges. You could literally name the latter “CRAFTING OFF SEASON” or something like that. It would be the ultimate way for these projects to keep fans/collectors engaged year round, so hopefully some of them see it that way!

Make users care about economics. NFTs, one way or another, are largely about investing, and it’s not asking too much for people to learn how markets function. Over time, with burning implemented, supply/demand would be a topic of much discussion, and would turn many average users into far more knowledgeable traders. Which isn’t a bad thing!

Burning fails. Yes, a very real possibility. I’m a burning maxi, so obviously I’m optimistic and trying to push a narrative where burning rights the ship. But there’s a very real scenario where burning dynamics bounce right off the ecosystems, barely making a blip, and where we soon discover that apex of NFTs is actually 10,000 supply profile pic projects. Certainly hope I’m wrong there ;)

What We Really Want

It’s no secret that sports league NFT projects are ready to move to the next phase (otherwise, I’d be writing about something else). The Top Shot boom is long over, and selling endless supply of no-name players is not a long term strategy, nor will it continue for very long without some kind of major change.

At the end of the day, it’s important to remember what truly is the driving force here: money.

People want to make money.

NFTs are the most volatile, scam-riddled market there has been in a long time, and most collectors (myself included) are driven by the potential to make oodles of cash, or at the very least, accumulate assets that are worth lots of cash.

The possibility of making money, even if it’s small amounts, is what has driven many in this market since the Cryptokitties days. And it will continue to drive it until new use cases are developed for the technology.

Very soon, one of these projects will find the perfect balance of gamification, burning, predicting, grinding, and passion-driving. One of these will find a way to reward its users for paying attention, playing the game, and burning appropriately.

And the one that does will be the second coming of NBA Top Shot—whether it’s them or someone else!

On My Mind This Week

NFL Rivals NFT Game Coming Soon on NFT Evening

Communities Aren’t Buckets - They’re Clouds by Joey DeBruin

ENS DAO is Planning PFPs by ENS DAO

Dynamic NFTs and Their Use Cases by Chain Link

Moar At The First Mint

Top Shot Newsletter: It’s ShowTime by GhostofGregOden

Live Show June 2nd: NBA Finals Showdown by The First Mint

Pod #162: Soulbound Tokens Are Coming by LG Doucet

Pod #161: Prep for NFT Winter by LG Doucet

Pod #160: What To Trust in Web3 by LG Doucet

About The First Mint

The First Mint is a web3 media company. We make. We write. We talk. We listen.

nice submarine stack