How To Mint The Next Big Thing 🚀

We welcome guest writer BCheque to tell us the tale of the Pepe Checks and how to spot the next major trend.

Before we start: Bombshell news today as a scathing article came out attacking the CEO of Dapper labs for bullying and a lavish lifestyle. We recorded an emergency pod here!

🚀 How To Mint The Next Big Thing | Guest Writer

This is our first guest piece at The First Mint! Over the course of 2023, we’ll be featuring new voices and perspectives from the broader NFT community - all designed to broaden our perspectives and learn a thing or two.

BCheque is an NFT Writer, Collector, Trader. He traded his way from 2E to 150E between 2021 and 2022. He writes a weekly newsletter for his 1600+ subscribers.

What’s up everyone. BCheque here.

This article will answer two questions:

How to find out about NFT projects early

How to evaluate the strength of a project quickly

I will show you how to keep your eyes open - step-by-step.

The article uses Pepe Checks as an example - this represents the real-time thinking and research I conducted a couple of weeks ago when analyzing this project.

Background

The Pepe Checks derivative created by Vince Van Dough - a prominent digital art collector - was minted 237,869 times.

They were sold at $6.90 each and the total sale raised 975 ETH ($1.6M). They are now trading at around $40 each after Vince Van Dough announced they would serve as raffle tickets to the Notable Pepe ecosystem.

1. Research the founder

Vince Van Dough’s bio does not fully reveal his importance or standing in the space. If you did not know otherwise, you may mistake him for just any other NFT degenerate who is a “purveyor of shitcoins and fine art.”

He is not just another NFT trader or collector. Here’s why:

His wallet has collected more than 4,000 NFTs. He even spent $300k on just six of them.

He is leading The Art of This Millennium Gallery. This digital gallery represents an all-star group of artists in the space.

He was involved in collecting art for huge prices under the Starry Night banner with Three Arrows Capital (Kyle Davies and Zhu Su’s trading firm which was one of the biggest in the space before collapsing).

The point being: he has been around for some time buying, collecting, establishing relationships, and helping to build out the space.

If you didn’t know that, you would not have recognized the opportunity.

With that level of expertise and influence in the space, what he focuses on or produces will get attention.

2. Understand the reason for the project’s existence

Jack Butcher’s Checks project blew up in January.

It went from a mint of $8 to a $3000+ floor over the course of a month.

It has captured the minds of many big artists, collectors, and thinkers in this space. (I wrote about it in a previous article: $8 to $2,600 In 30 days)

Without the success of Jack’s project, Vincent Van Dough’s derivative would not have existed.

But not only did Jack’s project sustain; Jack changed the metadata of his Checks project to show the image of Vincent Van Dough’s Pepe Checks project.

This added rocket-fuel to the project (because obviously…see Pepe Check…buy Pepe Check!)

3. Listen to the surrounding conversations

Whilst not necessarily a “catalyst” like the underlying value proposition delivered by the artists/producers already mentioned, Pepe Checks were also on my radar via my friend Flywheel, who presents his theses to his group.

My understanding is he has quite a track record of predicting successful projects. So much so that I was happy to join his group FlysAlpha to hear his perspectives.

He mentioned the project early to his circle - and that appears to have worked out well for those who got involved.

Being a part of these types of conversations early is important when evaluating a new project.

Enjoying this? Subscribe to The BCheque Papers today ✅

4. Watch for derivatives

Lots of derivatives is always a positive for a project because it shows that the underlying project has a memetic quality and people want to reproduce it in some way. Derivatives sprung up rapidly for this project.

I present here a few which caught my eye and made me smile.

5. Follow clues and actions

This is risky when nothing is confirmed, but when you do not know what is happening it is better to follow actions rather than words.

I noticed this investigation from a big crypto/nft trader.

VVD = Vincent Van Dough, the artist.

This made people think something might be “planned” for the collection.

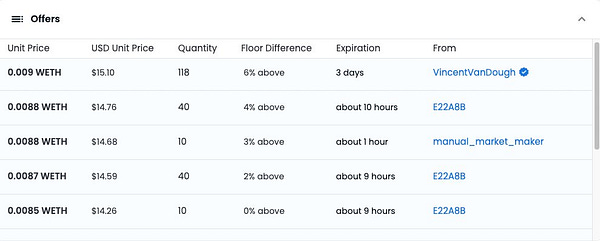

And I also saw that VVD was buying his own creation post-mint. (Nice to see after I had bought in on the above speculation..)

So much so that VVD became the second largest holder quickly.

And he has subsequently become the largest holder (2,260 NFTs) in short time.

Seeing this sort of backing by the founder gives me some confidence that the NFTs themselves will be useful for something. (Of course, without any official announcement, you can never know…)

Conclusion

The five ways to discover and evaluate new projects quickly.

Research the founder

Understand the reason for the project’s existence

Listen to the surrounding conversations

Watch for derivatives

Follow clues and actions

I hope this was helpful insight into the project; and a helpful look at the “due diligence” and investigative/analytical process.

Give a BCheque a follow for some more of this!

**This is not financial advice. Nothing in this newsletter, podcast, or publication should be considered financial or trading advice of any kind. Please do your own thorough research and make your own trading decisions. This is not advice.”

About The First Mint

A web3 sports community. Podcasts. Newsletters. Events.

Tweets and Newsletters are not endorsements.