What’s up everybody, it’s LG Doucet here.

Well well, if it isn’t our friend, the bull market. After weeks of podcasts where we discussed these long bear market conditions, and featured Macro experts, Veteran Investors, and NFT OGs, crypto seems to be rebounding!

Which is convenient, given that for today’s podcast, I wanted to focus on one of the cryptocurrencies nearest and dearest to our community’s wallets: $FLOW.

Last week, Dapper wallet’s integration with Instagram went live for a few select users, and although this partnership had been reported months prior, this particular bit of news sent the token surging 40%.

Which gave me pause. Why now? Why this specific news piece? After all if you visit the FLOW website it not only lists Instagram, but other web2 giants like Shopify and YouTube. And from what I understand, we’ll also soon see our FLOW assets compatible with OpenSea.

Only one way to make sense of this…

🟢Today’s Pod: The Fate of $ FLOW

This is not financial advice.

I repeat, this is NOT financial advice. We rarely discuss token prices at TFM, and almost never go in-depth on tokenomics.

But FLOW is a special case.

It’s the undercurrent to many NFTs we collect (TopShot, All Day, etc.)

It’s the brainchild of NFT OGs (Dapper folks)

It’s currently at 74% circulating supply, as per CoinGecko

And…its the only currency that’s promised us a “🚚 load” airdrop, which is reportedly coming at the end of this month.

So it’s worth a look.

How do we categorize an asset like FLOW?

It’s difficult to categorize a currency like FLOW. It’s an asset, maybe an investment, but also so much more as the underlying currency of a massive blockchain.

For us investor/trader/degens, we can visualize this type of token in four parts:

a Stock: Although not a security (yet), last week made it clear that this token moves on good/bad news. And like stocks, early investors gain early access at a better price.

a Commodity: blockchains are going to be useful right? So just like copper, coffee, or oil, those who control the resource will make the market. And as market participants, we get to vote with our wallets as to wether we think this commodity will be wanted in the future.

a Security Language: Yes, I just made that term up. But blockchains like FLOW, Ethereum, and Solana all represent this new ledger-based security system that’s supposed to change the world. It’s tech.

an Ideology: crypto is many things, and a mindset more than the rest. The decentralized world, empowerment to the consumer, the people, and an Internet of Value. Buying a token like this shows you believe in this.

We could circle on these categories for hours. But what we’re after today isn’t crypto philosophy, but the answer to a simple question: What’s next for the FLOW token and How much of that sweet Dapper airdrop are we gonna receive?

Only one place to start for that.

FLOW Tokenomics

Now there is very little findable information on the tokenomics for Flow. Or at least recent stuff.

But I was able to dig up this Whitepaper on FLOW Token Distribution, which appears to have come out in mid-2020. I based the research on this.

In this paper, the team shows three phases to the token distribution:

Phase I: Beta Mainnet Live, which occurred on May 15, 2020.

Phase II: Token Generation + Distribution

Phase III: Staking Rewards Begin

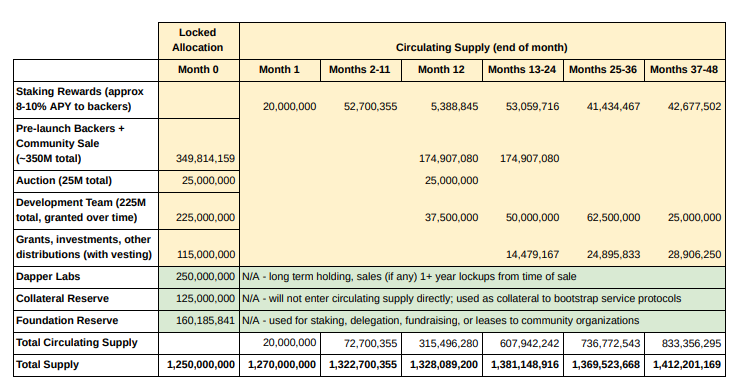

The fun starts in Phase II, where its noted that 1.25 Billion token were created at genesis of the FLOW chain, and the following chart is presented for distribution:

Pretty typical token distribution. The paper also elaborates on each one and what the terms are for token allocation. Notable from this section:

The large/small backers are on a 24-month vesting (i.e. locking of the token), meaning their tokens are unlocking around now.

The development team (employees) is on a 36-month vesting, albeit with a 1-year cliff, meaning some of that can be unlocked after a year.

The community sale occurred in September 2020. Token was sold at $0.10 USD with a 1-year lockup. So those are in circulation now.

The ecosystem development is massive but also somewhat ambiguous. I believe this matured into the $725M Ecosystem Fund launched in May 2022, along with more VC-funding to back it up.

Phase III isn’t anything too wild; it details the rewards for node validators and stakers, which is something we as users can actively do (the APY staking rate for FLOW on the blocto wallet is currently 8.84%).

At the end of the paper, we come to the most important part; the distribution.

Again, pretty typical so far for any tokenomics.

However, this is a two-year old paper, and the numbers aren’t accurate today. Per this WP, we should be at 44% circulation of the token.

However in reality, we’ve already hit 74% circulation, as per both CoinGecko and CoinMarketCap. So perhaps some tokens became available much earlier than expected!

Either way, this figure should be good news for those investing/holding/expecting the FLOW token. If we’ve learned anything from Top Shot, is that a high circulation count is good for price stability.

So How About That Airdrop?🪂🪂

Ok so now to the big question. How much are we getting in this

Lets make some assumptions:

Assume Dapper truly has 1 million active wallets (although its likely closer to 450k that have ever done a transaction)

Assume Flow unlocks at extra 10% of token supply for the drop (140M)

That would give us approximately 140 FLOW tokens per user, so about $413 USD by today’s prices.

Not bad. But there’s a bigger question lingering here…

How Will FLOW Stay Liquid?

I realized in writing this pod that there’s no direct exchange in the Dapper wallet. As in you can’t trade one currency for another.

So let’s say even just half of those 1 million users want to liquidate that sweet FLOW. How will they do it?

Is the plan to send them all to BloctoSwap, and force them to manually transfer their FLOW tokens to another wallet, then convert them to $FUSD or $USDC? Seems super complicated for an airdrop.

Or perhaps the FLOW will be locked to the wallet, same as “non-withdrawable” funds, and can only be spent on the marketplaces. That would be wild!

The pod.

Alright enough typing. All these figures, thoughts, and stats are included in this week’s pod, so please enjoy.

Featured in this one:

Instagram blew up the FLOW token (01:00)

Focusing on consumer-friendly tokens (04:10)

These types of tokens are NOT your typical stock (06:20)

What we know about FLOW (08:00)

What about the price of the token (13:40)

1.25 Billion Flow Tokens created at genesis (15:00)

Tokens for validators (18:30)

74% of token supply has been released (21:45)

The potential airdrop amount (24:00)

🚀The First Mint in AdWeek!

Oh yes. We made the big boy magazine.

I was recently interviewed for a piece about Brands entering the metaverse titled Patience and Observation Are Your Best Bets to Foray Into NFTs.

As you know, I come from a content marketing background, and brands are near and dear to my heart (which has obviously shaped many of our partnerships).

I’m always keen to help the normies understand the big picture here, and discussing this with the write Will Eagle was an absolute pleasure.

My old colleagues would be jealous they didn’t jump to crypto proud.

📺 ICYMI: Value in the Bear Market | Tascha Labs

What’s that about the Macro conditions?

Last week, we featured one of the biggest brains in the space, Tascha. This was a pod less so about speculation and financial advice, and more so about the biggest picture on crypto and NFTs.

Tascha gave us some all time hits, including:

we have tokenization, but we don’t have value

how permissionless capital and trade are the key to crypto’s success

web3 is still at the web1 crash stage; only 5% of the world has used it

her issue with NFTs right now

Have a watch/listen:

What the community had to say:

The First Mint is proud to be partnered with Flowty, a peer-to-peer NFT loan and rental platform on the Flow Blockchain founded by Michael Levy (fondly known as MBL throughout the Top Shot community):

Are you an NBA Top Shot collector / investor? Did you know that you can do a LOT more with moments than just buy and sell them?

Need help completing a Top Shot challenge? Rent on Flowty.

Have extra moments for a challenge and want to generate income in a safe way? Rent out your moments on Flowty.

Need liquidity but don’t want to sell your moments? Use moments as collateral to take out a loan on Flowty.

Looking for an alternative way to invest in Top Shot? Generate passive income by lending (funding loans) on Flowty.

Flowty’s rental and loan marketplace allows renters, owners, borrowers and lenders to transact in a safe and easy way!

Want to learn more? Join the Flowty Discord and follow along on Twitter at @flowty_io.

✨Happening at The First Mint

Each week we publish a podcast about NFTs and the bigger questions of web3. Check out some of our recent faves!

🎙️Value In The Bear Market | Tascha Labs

🎙️What Makes an NFT Bull Run | Mack Flavelle

🎙️Crypto Portfolio 101 | Scott Melker

🎙️The Future of Crypto Media | Tally Labs

**This is not financial advice. Nothing in this newsletter, podcast, or publication should be considered financial or trading advice of any kind. Please do your own thorough research and make your own trading decisions. This is not advice.”

About The First Mint

The First Mint is a web3 media company. We make. We write. We talk. We listen.